Socialism is Here: 96.5% of Mortgages Backed by Government entities in Q1

96.5% of Mortgages Backed by Government entities in Q1

From Nick Timiraos at the WSJ: U.S.

Role in Mortgage Market Grows Even Larger

puts this in perspective (from Oct 2009): Recent

Developments in Mortgage Finance

slightly larger in new window.

This is figure 3 from the Economic Letter.

by CalculatedRisk on 5/01/2010 08:42:00 AM

From Nick Timiraos at the WSJ: U.S.

Role in Mortgage Market Grows Even Larger

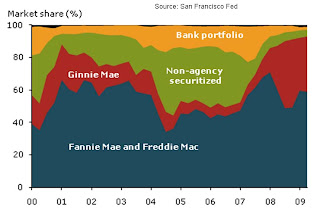

Government-related entities backed 96.5% of all home loans during the first quarter, up from 90% in 2009, according to Inside Mortgage Finance.The following graph from San Francisco Fed Senior Economist John Krainer

puts this in perspective (from Oct 2009): Recent

Developments in Mortgage Finance

As the U.S. housing market has moved from boom in the middle of the decade to bust over the past two years, the sources of mortgage funding have changed dramatically. The government-sponsored enterprises—Fannie Mae, Freddie Mac, and Ginnie Mae—now own or guarantee an overwhelming share of originations. At the same time, non-agency mortgage securitization and loans retained in lender portfolios have largely dried up.Click on graph for

slightly larger in new window.

This is figure 3 from the Economic Letter.

[T]he sources of mortgage financeWithout the government backed entities there would be almost no mortgage market. We are a long way from normal ...

have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade.

Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations. Finally, the share of mortgages retained in the originating institution's portfolio averaged about 15% throughout the boom, but has fallen considerably since.

...

With the vast majority of current mortgage lending now intermediated in some form by the GSEs, it will be difficult for the housing market to return to normal.

Comments

Post a Comment