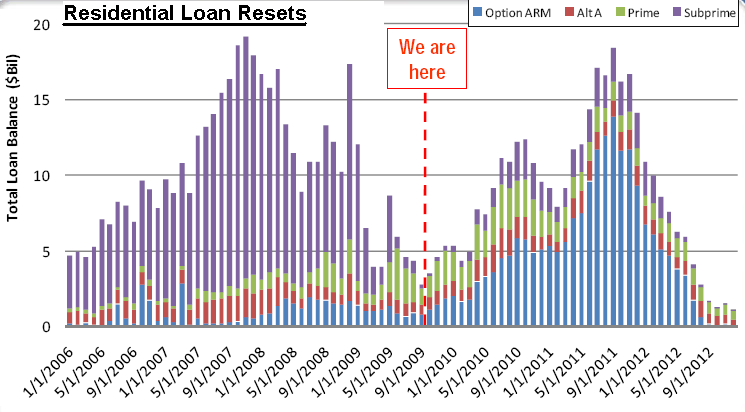

Coming Soon: The Bill for the Massive U.S. Debt

by Money Morning Americans could be in for a rude awakening in coming months when they discover the true scope of the massive national debt racked up by the U.S. government. In fact, the $1.6 trillion deficit expected for 2010, which is above 10% of gross domestic product (GDP), is only the beginning. Since the current economic crisis began in late 2007, the U.S. Federal Reserve has tripled the size of its balance sheet, creating enormous amounts of new money by lending to hundreds of ailing banks and buying up more than $1 trillion of questionable asset-backed securities. But that’s only a small part of the story. Since the beginning of the crisis, the Fed has lent, spent, or guaranteed $11.6 trillion, including underwriting the entire system of mortgage finance in the United States, a system that currently shows a nearly $1 trillion loss. And none of these figures include any of U.S. President Barack Obama’s stimulus packages, which means the actual deficit next y