ObamaCare: Three Months of Broken Promises

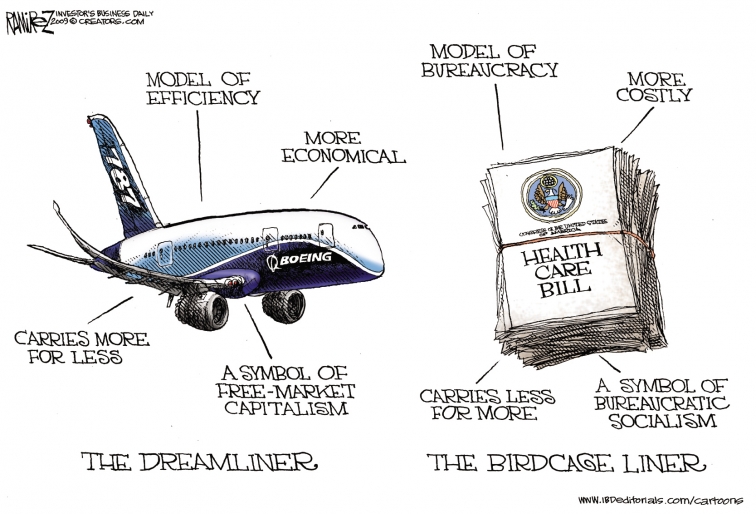

This past Wednesday marked the three month anniversary of ObamaCare being rushed through Congress and signed into law. As Speaker Pelosi famously stated that “we have to pass the bill so that you can find out what is in it,” Americans are beginning to dislike the health care law more and more as its harrowing details are unveiled. Although the Majority claimed the health care law would reduce premiums by $2,500, in actuality it is expected to raise premiums by as much as $2,100, according to the Congressional Budget Office. In addition, during debate of the bill, Democrats claimed their government takeover of the health care sector would create millions of new jobs. However, according to a study by the National Federation of Independent Business, the health care law’s employer mandate could eliminate 1.6 million jobs through 2014, with 66 percent of those coming from small businesses. Because the health care law raises health care costs and kills jobs, among other atrocities, Con...